Lucrative Art Investing: Made Accessible For Everyone Through Co-ownership

Image source: Wikipedia

Thank you for subscribing!

Have a great day!

Art has long been recognized as a symbol of cultural expression, creativity, and emotion. Traditionally, buying or investing in art has been perceived as an exclusive domain for the rich or even the super-rich. However, this is changing and through new approaches (like NFT) or fractional and co-ownership models art investment is becoming accessible for everyone.

In this article, I will delve into the world of lucrative art investing made accessible for everyone through co-ownership. I will summarize how traditional art investing works and its limitations. I will present a much better, much fairer model of investing that allows everyone to invest in art, including the Masterworks platform, some examples of their successful art sales with over 30% returns, and I will present insights into my own portfolio and my investment approaches.

Investing in Art: The Traditional Way

Image source: Wikipedia

Art – especially contemporary art – is an extremely interesting domain with a long history. I mean we have been producing art since the human species exists basically. It is part of the cultural expression no matter in what stage of development we were.

However, that is not the topic of this article. This article is about how we can invest in art and gain returns from it. This is also nothing new and the rich and super-rich have invested in blue chip art for decades. These purchases are often crazy. The art piece above is Salvator Mundi by Leonardo Da Vinci. It was bought by Saudi Arabian Prince Badr bin Abdullah at a Christie’s auction in New York in 2017 for over $450 million. This is currently the most expensive art ever sold. Another one I shared at the very beginning of this article by Paul Cézanne called The Card Players. This piece was sold in 2011 for $250 million. Then there are other pieces that are considered priceless like the Mona Lisa by Leonardo Da Vinci. It is said that it’s worth $800 million, which is an assumption based on its insurance.

So, this is another world and basically not accessible to us normal folks. Even if we look at much, much cheaper traditional art investment options, it is still a tough area. It does make a lot of sense for portfolio diversification especially because value fluctuation of art has very little correlation with stock or other asset classes. But it will remain a very expensive asset class, and typically we don’t want to invest more than 5-10% of our portfolio in art. In addition, it’s not enough to simply be familiar with art. You need to be an expert and get access to the corresponding circles.

And that is the problem, and also why the traditional model of art investing is pretty much useless for us normal mortals. But what if I’d tell you there is a much better model that will democratize art investment and make it accessible for everyone?

A Much Better Model: Co-Ownership For Everyone

Traditionally, investing in art required substantial capital, as purchasing a piece often meant owning it outright. This exclusivity has deterred many potential investors from entering the art market. However, we do see a shift that will transform the whole world of art investing and make it accessible to everyone. This new model is referred to as co-ownership or fractional ownership.

The idea is to allow multiple investors to collectively own shares of valuable artworks. This is not only restricted to art. The model is also applied to, for example, farmland, music, or collectibles such as cars or watches. NFTs (Non-Fungible Tokens), which is art in the crypto space, follow a very similar model but are a very complex domain. I go into detail in my other article How to Sell NFT Art.

Co-ownership not only reduces the financial barrier to entry but also spreads the risk among investors. This democratization of art investing allows individuals to participate in the potential appreciation of art value without bearing the full burden of ownership costs. For instance, if a painting's value appreciates over time, all co-owners benefit proportionally, enabling even small-scale investors to gain from the art market's growth.

The Potential for High Earnings: Where Creativity Meets Investment

Art clearly has the potential for impressive financial gains over the years. While the art market can be volatile, the potential rewards can be substantial for those who carefully navigate its waters. Depending on different reports the annual returns can range between 7.6% all the way up to 25% (Citi Bank report).

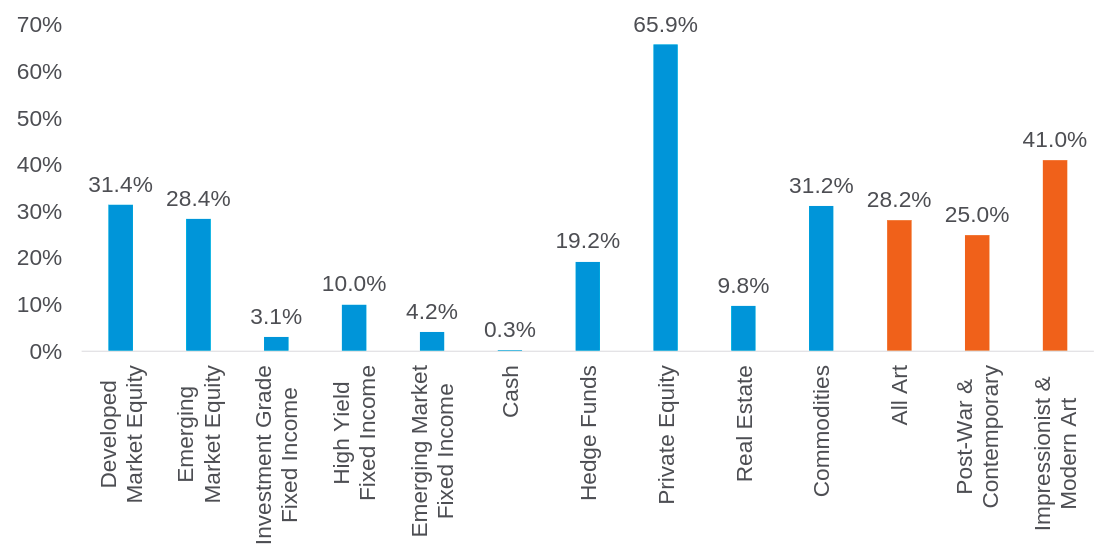

The chart below shows a comparison of the annual returns of different asset classes in 2020 and 2021. Returns from art are comparable to stock market returns from emerging countries and commodities (including metals, energy, and agricultural products) but are way above real estate or hedge funds.

Source: Citi Bank’s “Global Art Market Disruption” Report 2022

These returns from art investing are extremely attractive. Another aspect that makes art attractive is the very little correlation with all the asset classes shown in the above chart. There is very little to no correlation or even negative. The strongest correlation according to the Citi Bank report is with real estate (0.21). So, this makes it an excellent choice to diversify a portfolio and spread the risk.

A final potential barrier to entry for new investors interested in the co-ownership model is knowledge. To make good decisions about what art to invest in requires you to familiarize yourself with artists, auction sales, price trends, and lots of analysis. Ideally, you need to immerse yourself in the world of art and understand how to value art properly. Done diligently this is a full-time job. Impossible for most of us.

To help us out, more and more online platforms emerge that support the co-ownership model for art and do the heaving lifting for us investors. One of these platforms is masterworks.io which enables investors to research, select, and invest in a diverse range of artworks in a very intuitive way – without the need for extensive art market expertise.

Masterworks: Bridging the Gap Between Art and Investment

The mission of Masterworks is “to make art investable”. They are the first and leading company for buying and trading shares in multi-million dollar, blue-chip artworks. Based out of New York City and with over 215 employees they built and offer a complete platform for investing in art. This allows us investors to build a diversified portfolio of iconic works of art curated by their industry-leading research and acquisition teams.

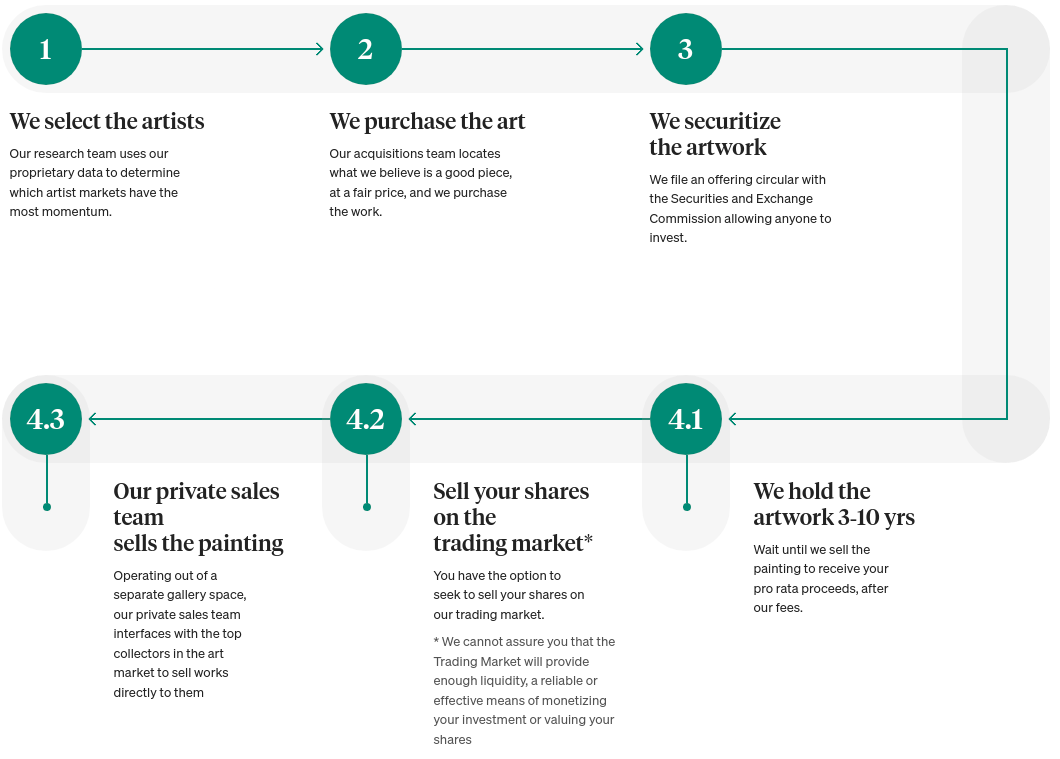

All of this follows the co-ownership model and you decide how many “shares” of a piece of art you want to acquire. The minimum investment is currently $500, which is now a completely different ball game compared to the traditional art investing model that I outlined at the very beginning of this article. The diagram below outlines the investment process with Masterworks. An interesting option is also that you could buy your shares on their in-house trading market to other investors (see point 4.2 in the diagram). This gives you more flexibility in changing the composition of your portfolio without the need to wait until the whole piece is sold, which can take several years.

Masterworks meticulously curates a portfolio of iconic artworks with the potential for significant appreciation. Through its user-friendly platform, we investors can explore detailed information about each artwork, the artist's background, and the historical context surrounding the piece – including previous sales, price appreciation and sale of similar artworks. We can make a lot more informed decisions aligned with their financial goals and risk tolerance without the need for extensive research across many different sources.

Examples of Extremely Successful Co-owned Art Sales

To illustrate the potential effectiveness of Masterworks, consider the following examples:

Albert Oehlen: Doppelbild

In 2022, Masterworks sold Albert Oehlen’s Doppelbild for $2.7M. This resulted in an annualized net return of 36.2% for the investors.

Guess who co-owned this one too! ;)

Sam Gilliam: Lady Day II

In 2020, Masterworks sold Sam Gilliam’s Lady Day II for $2.17M. This resulted in an annualized net return of 33.1% for the investors. The total gross appreciation over 15 years of this art piece is 395x.

How Investing in Art Fits into My Vision

As I wrote in my article How To Maximize Happiness, my purpose in life is to maximize happiness for me and the people around me. I achieve this by following the Happiness Formula, which is about health and freedom. A critical part of freedom is financial freedom. I have a whole strategy around this including a diversified portfolio of investments.

Through diversification, I can spread the risk but also it satisfies my hunger for learning about new things. Art was totally new for me. So, it is a perfect candidate for me as a further asset class for alternative investments. About 10% of my current portfolio are what I consider alternative investments. About 1.5% currently are made up by investments in art. Everything I know so far makes art an extremely attractive investment option and I will bump up this to about 5% of my portfolio. You can read about other interesting investment ideas in my articles about organic almond farming, solar energy, crypto, tiny houses, a fitness business, or a camper van business.

How are my art investments going?

Generally, I really like this asset class due to its features outlined earlier like a strong rate of return, very little to no correlation with other asset classes, high appreciation, and now via Masterworks I also have a platform that reduced the barrier to entry for me. I use Masterworks to research, select, transact, monitor, and even potentially sell my shares invested in artworks.

So far, I exited one art: Albert Oehlen’s Doppelbild and my return from this was a whopping 32.6%. Currently, I hold fractional ownership of 14 other artworks on Masterworks. One cool thing about Masterworks is that they automatically calculate and present to you the Sharpe ratio. The Sharpe ratio compares the return of an investment to its risk adjusted to a risk-free rate. Generally the higher the Sharp ratio the better. Anything above 1 is considered good (cf. the current S&P 500 Portfolio Sharpe ratio is 0.45). Anything about 2 is awesome. My current Sharp ratio on Masterworks is 1.14. The investor average is currently 1.16, so I need to catch up. Every new artwork also shows its Sharpe ratio. That will help my buying decisions and I will improve the return potential of my portfolio over time by investing accordingly.

On a side note: I also own some NFTs which I actually created and published myself (called Augmented Virtuality Art). But this was more for fun, to dive into this domain and get to understand the necessary technologies and concepts. NFTs did not deliver any financial returns for me (yet).

Everyone Can Gain From Art Investing Through Co-ownership

Art investment is no longer an exclusive domain reserved for the wealthy. With platforms like Masterworks, co-ownership models, and a growing recognition of art's potential for high earnings, art investing has become accessible to everyone.

In this article, I discussed how lucrative art investing is made accessible for everyone through co-ownership. I covered art as an excellent way to diversify your portfolio to reduce risk with an asset class that is uncorrelated with most other asset classes. I introduced the masterworks platform and its extremely user-friendly way to get access to high-yield investment opportunities in art via fractional ownership. I also presented some of my own successes and how my portfolio is set up.

If you are interested in joining Masterworks you can use my invitation link to jump the wait list and we both get a $200 bonus (or click the button below).

Full Disclosure and Disclaimer:

I am a registered user on the Masterworks platform. If you do sign up using my invitation link we both get a $200 bonus. There may be other affiliate links used in this article.

I am not a financial advisor. I present my view on things that work well for me. I am not taking any responsibility for your decisions. Always do your own due diligence before you invest.